CORPORATE SOCIAL RESPONSIBILITY

The Rhode Island Joint Reinsurance Association, also known as the Rhode Island FAIR PLAN, is an organization privileged and committed to providing property insurance, on behalf of the insurance industry, to individuals unable to secure insurance through the voluntary market. The term FAIR stands for Fair Access to Insurance Requirements. We take our responsibility as the FAIR plan very seriously and always aim to provide first class service and support to our insureds.

RIJRA receives management services for the FAIR Plan through a service agreement with Massachusetts Property Insurance Underwriting Association (MPIUA). MPIUA provides staff support and services to RIJRA, RIJRA does not have any direct employees.

We believe in supporting and giving back to our community and staff through a wide variety of causes and resources. We take pride in our commitment to continuously work to expand and enhance our Corporate Social Responsibility (CSR) plan. We believe that our CSR initiatives reflect the core values of our organization. The FAIR Plan’s goals are to always look ahead and to strive to make a positive impact on our staff and in our community.

We promote charitable giving and volunteerism. We are always seeking to improve our organization’s policies in support of a diverse, equitable and inclusive work environment, and ways to minimize our environmental footprint.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE INITIATIVES (ESG)

Environmental, Social and Governance Initiatives (ESG) includes diversity, equity and inclusion, climate, corporate and social responsibility, and investment strategies. The FAIR plan has established the following Initiatives to support our ESG efforts.

- ENVIRONMENTAL

- The paperless submission of insurance applications and endorsements by applicants and insureds, as well as inspection reports, has become a hallmark of RIJRA’s goal of preserving the environment. Currently, RIJRA receives 99.9% of such documents, which total approximately 54,000 page equivalents per year, electronically;

- Converting to EPA certified Smart Way Vehicles;

- RIJRA operations are handled at Two Center Plaza, Boston MA which is a LEED’s Building;

- Paper recycling, as well as paperless submission and paperless internal workflows in each of the operating departments, and a plan to move to digital distribution processes, including electronic delivery of policy forms and other communications;

- Hybrid work model to decrease travel and fossil fuel usage;

- IBHS initiatives for home resiliency, particularly in light of climate change;

- Promote electronic and other waste recycling through the Center Plaza (Boston Office)sponsored recycling programs (i.e. gift cards as incentive);

- Earth Day activities, i.e. tree planting;

- Provide water filling stations and bottles to promote reusable bottles and reduce plastic use.

- The FAIR Plan recognizes a series of risks to the Association, its Member Companies and insureds due to climate change and with approximately 50% of our policyholders’ properties located within the coastal territories, the Committee is committed to robust catastrophe and business continuity plans, as well as to the purchase of a substantial property catastrophe reinsurance program.

- SOCIAL

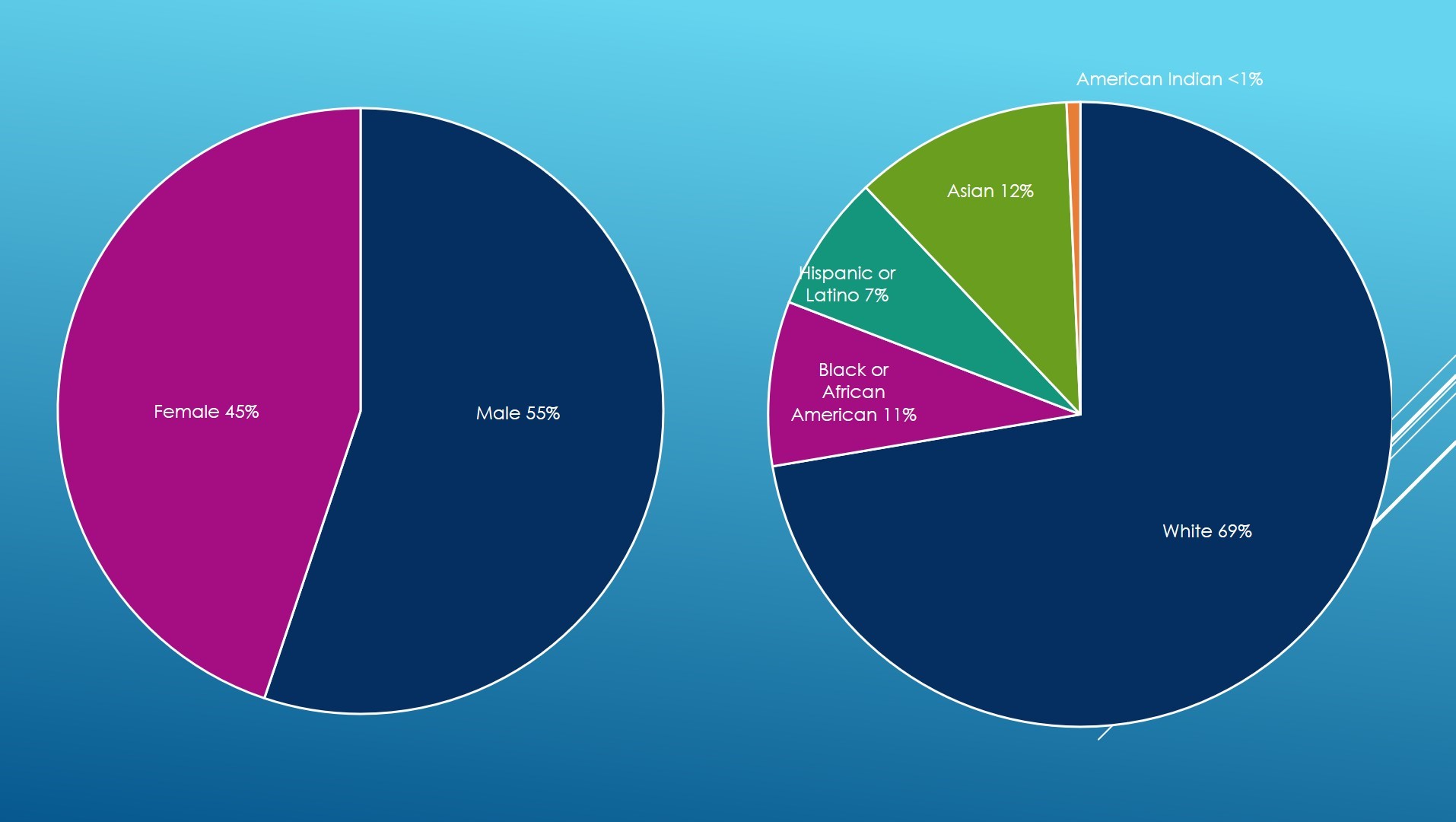

- The MPIUA/RIJRA workforce is diverse and inclusive with 45% of employees being female, and 30% of employees being a race or ethnic group identified as other than white.

- RIJRA sponsored charitable and volunteer programs in place:

- Dana Farber/Jimmy Fund

- Habitat for Humanity of Greater Providence

- Rhode Island Community Food Bank

- MEANS

- Rhode Island Coalition to End Homelessness

- Support volunteer efforts to Rhode Island community based organizations working on racial, economic and social justice.

- Promote employee participation in blood drives through Red Cross (i.e. Paid Time Off as incentive)

- Provide an Association Matching Charitable gifts program which matches employee charitable contributions up to $250 per employee per calendar year.

- Promote home safety and loss prevention through annual and seasonal brochures and on the RIJRA website, such as notifications on fire safety, freeze ups and hurricane/winter storm preparedness. Additionally, the Association’s website contains links to the Institute for Home Safety to provide resilient building and loss mitigation information.

- Promote employee health and wellness through group health insurance, fitness and nutrition programs (i.e. Paid Time Off as incentive).

- The Association has the capability of almost entirely 100% remote work and has recently shifted to a hybrid work model to promote our culture, as well as a collaborative environment while simultaneously supporting flexibility for a healthy work-life balance.

- Promote and provide access to Financial Wellness Education and Financial Counseling.

- Monthly Employee Newsletter that promotes engagement and connection to continue to cultivate an inclusive employment environment.

- The MPIUA/RIJRA workforce is diverse and inclusive with 45% of employees being female, and 30% of employees being a race or ethnic group identified as other than white.

- GOVERNANCE

- The RIJRA FAIR Plan is a statutorily-created association which is governed by a Governing Committee comprised of ten (10) of the Members elected annually to serve on the Governing Committee, with at least two (2) of such Governing Committee members being domestic insurers and not more than one (1) insurer in a group under the same management or ownership serving on the Governing Committee at the same time.

- Through MPIUA’s Executive Committee, the MPIUA Board of Directors promotes the values of the Association by its oversight of the human resource function, including pay and pay equity, succession planning and enterprise risk management of the Association.

- Through the Audit and Accounting Committee, the Board oversees the risks associated with Accounting, auditing, internal controls and financial reporting, as well as the RIJRA’s Whistle Blower Policy, which includes an anonymous hotline directly to the Committee Chair.

- High among the Association’s priorities under enterprise risk management which is overseen by the Executive Committee is the risk of cyber security breaches. The Governing Committee and Management is fully committed to protecting the data privacy and the personally identifiable information of our customers and employees and has adopted and will continue to evaluate new technologies to achieve its security goals.

- As an Equal Opportunity Employer, MPIUA/RIJRA, utilizes a diverse selection of recruitment resources to attract talent.

- Consider the goal of diversity in all management succession planning within the Association;

- Conducted survey and providing ongoing formal education to all employees on diversity, equity and inclusion;

- Formed employee committee to make recommendations on diversity, equity and inclusion initiatives.

- Promote insurance education, primarily sponsored by the Insurance Library, for employees to provide for job advancement.